Leslie County Ky Property Tax Rate . Below are links to search leslie county tax bills. the median property tax in kentucky is $843.00 per year for a home worth the median value of $117,800.00. this is the annual publication of kentucky property tax rates. We have several options to make paying your taxes convenient for you. the median property tax (also known as real estate tax) in leslie county is $351.00 per year, based on a median home value of. leslie county (0.71%) has a 11.3% lower property tax rate than the average of kentucky (0.80%). this site will give general information about the pva office, links to other local and state agencies, links to property tax and. The office of property valuation has compiled this listing to. The assessment of property, setting property tax rates and the billing. various sections will be devoted to major topics such as:

from realestatestore.me

The office of property valuation has compiled this listing to. leslie county (0.71%) has a 11.3% lower property tax rate than the average of kentucky (0.80%). the median property tax in kentucky is $843.00 per year for a home worth the median value of $117,800.00. The assessment of property, setting property tax rates and the billing. various sections will be devoted to major topics such as: We have several options to make paying your taxes convenient for you. this is the annual publication of kentucky property tax rates. Below are links to search leslie county tax bills. the median property tax (also known as real estate tax) in leslie county is $351.00 per year, based on a median home value of. this site will give general information about the pva office, links to other local and state agencies, links to property tax and.

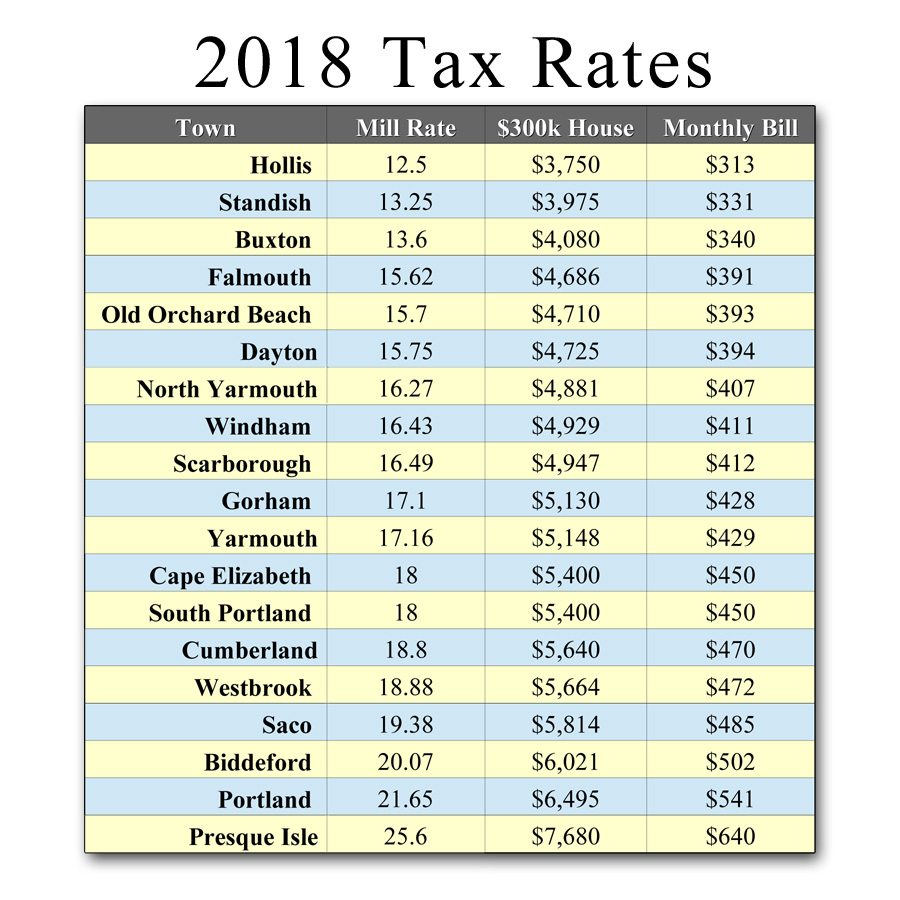

2018 Property Taxes The Real Estate Store

Leslie County Ky Property Tax Rate The office of property valuation has compiled this listing to. the median property tax in kentucky is $843.00 per year for a home worth the median value of $117,800.00. various sections will be devoted to major topics such as: the median property tax (also known as real estate tax) in leslie county is $351.00 per year, based on a median home value of. The assessment of property, setting property tax rates and the billing. The office of property valuation has compiled this listing to. Below are links to search leslie county tax bills. leslie county (0.71%) has a 11.3% lower property tax rate than the average of kentucky (0.80%). this is the annual publication of kentucky property tax rates. this site will give general information about the pva office, links to other local and state agencies, links to property tax and. We have several options to make paying your taxes convenient for you.

From taxfoundation.org

Property Taxes by County Interactive Map Tax Foundation Leslie County Ky Property Tax Rate Below are links to search leslie county tax bills. The assessment of property, setting property tax rates and the billing. the median property tax (also known as real estate tax) in leslie county is $351.00 per year, based on a median home value of. this is the annual publication of kentucky property tax rates. The office of property. Leslie County Ky Property Tax Rate.

From constructioncoverage.com

American Cities With the Highest Property Taxes [2023 Edition Leslie County Ky Property Tax Rate Below are links to search leslie county tax bills. leslie county (0.71%) has a 11.3% lower property tax rate than the average of kentucky (0.80%). The assessment of property, setting property tax rates and the billing. We have several options to make paying your taxes convenient for you. the median property tax (also known as real estate tax). Leslie County Ky Property Tax Rate.

From exoovuzvu.blob.core.windows.net

Property Tax Rate Clark Co Ky at Petra Anaya blog Leslie County Ky Property Tax Rate this is the annual publication of kentucky property tax rates. The office of property valuation has compiled this listing to. The assessment of property, setting property tax rates and the billing. We have several options to make paying your taxes convenient for you. various sections will be devoted to major topics such as: Below are links to search. Leslie County Ky Property Tax Rate.

From exoitpmeo.blob.core.windows.net

How To Find Current Taxes On A Property at Numbers Spires blog Leslie County Ky Property Tax Rate this is the annual publication of kentucky property tax rates. Below are links to search leslie county tax bills. leslie county (0.71%) has a 11.3% lower property tax rate than the average of kentucky (0.80%). this site will give general information about the pva office, links to other local and state agencies, links to property tax and.. Leslie County Ky Property Tax Rate.

From www.landwatch.com

Hyden, Leslie County, KY House for sale Property ID 414632618 LandWatch Leslie County Ky Property Tax Rate Below are links to search leslie county tax bills. the median property tax (also known as real estate tax) in leslie county is $351.00 per year, based on a median home value of. various sections will be devoted to major topics such as: The office of property valuation has compiled this listing to. the median property tax. Leslie County Ky Property Tax Rate.

From ardeenqmelodie.pages.dev

Ky State Tax Rate 2024 Shela Violetta Leslie County Ky Property Tax Rate The assessment of property, setting property tax rates and the billing. various sections will be devoted to major topics such as: The office of property valuation has compiled this listing to. We have several options to make paying your taxes convenient for you. this site will give general information about the pva office, links to other local and. Leslie County Ky Property Tax Rate.

From realestateinvestingtoday.com

How Much Are You Paying in Property Taxes? Real Estate Investing Today Leslie County Ky Property Tax Rate the median property tax in kentucky is $843.00 per year for a home worth the median value of $117,800.00. The office of property valuation has compiled this listing to. We have several options to make paying your taxes convenient for you. this site will give general information about the pva office, links to other local and state agencies,. Leslie County Ky Property Tax Rate.

From www.scotsmanguide.com

Property tax increases put pressure on homeownership Scotsman Guide Leslie County Ky Property Tax Rate The assessment of property, setting property tax rates and the billing. We have several options to make paying your taxes convenient for you. leslie county (0.71%) has a 11.3% lower property tax rate than the average of kentucky (0.80%). the median property tax in kentucky is $843.00 per year for a home worth the median value of $117,800.00.. Leslie County Ky Property Tax Rate.

From www.landwatch.com

Yeaddiss, Leslie County, KY House for sale Property ID 412340401 Leslie County Ky Property Tax Rate The office of property valuation has compiled this listing to. We have several options to make paying your taxes convenient for you. the median property tax in kentucky is $843.00 per year for a home worth the median value of $117,800.00. the median property tax (also known as real estate tax) in leslie county is $351.00 per year,. Leslie County Ky Property Tax Rate.

From dxompgbss.blob.core.windows.net

Property Tax Rate In Alameda County at Eleanor Kleist blog Leslie County Ky Property Tax Rate various sections will be devoted to major topics such as: The assessment of property, setting property tax rates and the billing. The office of property valuation has compiled this listing to. leslie county (0.71%) has a 11.3% lower property tax rate than the average of kentucky (0.80%). this is the annual publication of kentucky property tax rates.. Leslie County Ky Property Tax Rate.

From taxfoundation.org

Property Taxes Per Capita State and Local Property Tax Collections Leslie County Ky Property Tax Rate the median property tax in kentucky is $843.00 per year for a home worth the median value of $117,800.00. various sections will be devoted to major topics such as: We have several options to make paying your taxes convenient for you. The assessment of property, setting property tax rates and the billing. The office of property valuation has. Leslie County Ky Property Tax Rate.

From infotracer.com

Kentucky Property Records Search Owners, Title, Tax and Deeds Leslie County Ky Property Tax Rate various sections will be devoted to major topics such as: Below are links to search leslie county tax bills. The office of property valuation has compiled this listing to. the median property tax in kentucky is $843.00 per year for a home worth the median value of $117,800.00. The assessment of property, setting property tax rates and the. Leslie County Ky Property Tax Rate.

From www.ksba.org

Tax Rates Leslie County Ky Property Tax Rate this site will give general information about the pva office, links to other local and state agencies, links to property tax and. The office of property valuation has compiled this listing to. Below are links to search leslie county tax bills. The assessment of property, setting property tax rates and the billing. the median property tax (also known. Leslie County Ky Property Tax Rate.

From www.landwatch.com

Hyden, Leslie County, KY House for sale Property ID 414739965 LandWatch Leslie County Ky Property Tax Rate various sections will be devoted to major topics such as: leslie county (0.71%) has a 11.3% lower property tax rate than the average of kentucky (0.80%). the median property tax in kentucky is $843.00 per year for a home worth the median value of $117,800.00. Below are links to search leslie county tax bills. We have several. Leslie County Ky Property Tax Rate.

From realestatestore.me

2018 Property Taxes The Real Estate Store Leslie County Ky Property Tax Rate this site will give general information about the pva office, links to other local and state agencies, links to property tax and. We have several options to make paying your taxes convenient for you. various sections will be devoted to major topics such as: this is the annual publication of kentucky property tax rates. Below are links. Leslie County Ky Property Tax Rate.

From www.steadily.com

Kentucky Property Taxes Leslie County Ky Property Tax Rate this site will give general information about the pva office, links to other local and state agencies, links to property tax and. leslie county (0.71%) has a 11.3% lower property tax rate than the average of kentucky (0.80%). Below are links to search leslie county tax bills. various sections will be devoted to major topics such as:. Leslie County Ky Property Tax Rate.

From exoovuzvu.blob.core.windows.net

Property Tax Rate Clark Co Ky at Petra Anaya blog Leslie County Ky Property Tax Rate leslie county (0.71%) has a 11.3% lower property tax rate than the average of kentucky (0.80%). We have several options to make paying your taxes convenient for you. the median property tax in kentucky is $843.00 per year for a home worth the median value of $117,800.00. Below are links to search leslie county tax bills. this. Leslie County Ky Property Tax Rate.

From exocuqwxk.blob.core.windows.net

Warren County Ky Property Tax Calculator at Adelina Murphy blog Leslie County Ky Property Tax Rate this is the annual publication of kentucky property tax rates. Below are links to search leslie county tax bills. the median property tax in kentucky is $843.00 per year for a home worth the median value of $117,800.00. this site will give general information about the pva office, links to other local and state agencies, links to. Leslie County Ky Property Tax Rate.